September 18, 2020

E-Commerce in Latin America: The COVID-19 Impact

In May we wrote about the impact of COVID-19 on e-commerce platforms in China, focusing on how differences in their business models and operations influenced their execution as the pandemic locked the country down.

In our latest Kora Insights post, we explore the impact of COVID-19 on e-commerce platforms in Latin America, and the similarities and differences to what happened in China. We then take a closer look at developments in Brazil, the largest e-commerce market in the region.

Offline retail – similar declines, uneven recoveries

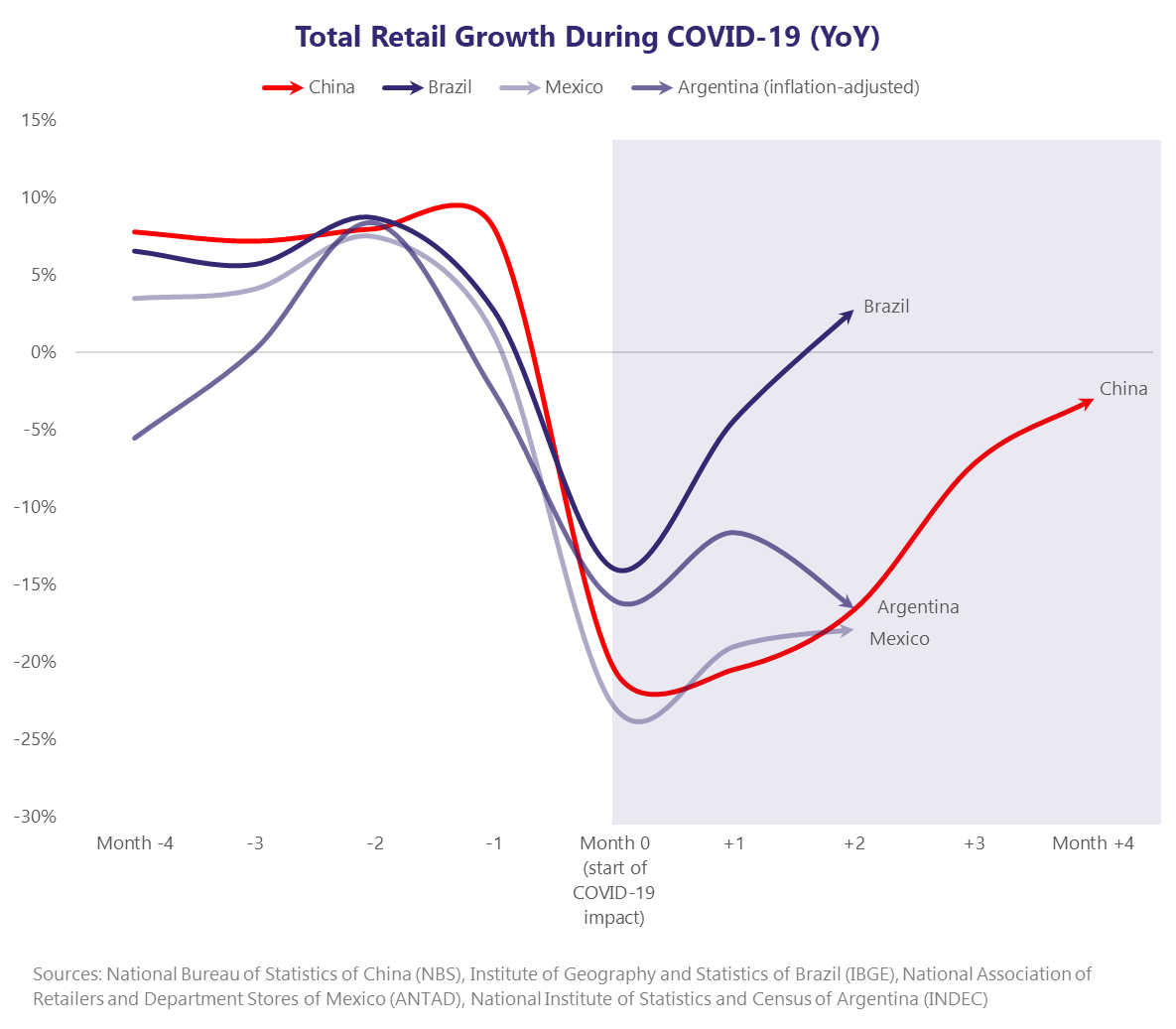

As in China during the first quarter of 2020, retail sales in Latin America declined sharply in the second quarter as COVID-19 (“COVID”) spread across the region. In China, where COVID was first identified, the government enacted comprehensive lockdown measures beginning in late January and early February. As a result, total retail sales initially fell more than 20% year-over-year but then swiftly began to recover. In Latin America, where government responses to the pandemic were less comprehensive, the initial declines in retail sales in the region’s three largest economies (Brazil, Mexico, and Argentina) were nonetheless similarly severe. The chart below compares total retail sales trajectories for these three countries, plus China, on a normalized time scale before and after the first COVID-related shutdowns.1

While the initial shock to the retail economy looks similar across countries and regions, the shape and timing of each country’s growth in the aftermath shows much more divergence. Interestingly, the country whose retail growth trajectory most closely resembles that of China – with an initial dip (not quite as deep) and a rapid subsequent recovery – is Brazil, despite the fact that its government’s COVID health policies significantly contrast with the approach taken in China. Longer-term retail trends between Brazil and China, alongside other measures of economic activity, will be interesting to compare in the coming quarters.

E-commerce – notable share gain

Looking at the performance of e-commerce in Latin America during COVID through the lens of MercadoLibre (“MELI”), the largest e-commerce platform in the region, the narrative is clear – online retail sales grew rapidly with the onset of COVID.2

The COVID-driven e-commerce growth in April and May was extraordinary in pace but not sustainable, as evidenced by the decline in subsequent months. In the coming quarters, we expect both the pace of e-commerce growth and the historic weakness of offline retail to normalize. However, we view recent trends not simply as temporary demand (i.e., customers being forced to buy online because stores are closed or out of stock), or demand pulled forward (i.e., stockpiling products that would otherwise have been purchased later), but as the future pulled forward – in other words, we believe this shift to online commerce will be lasting.

Our analysis of the implications for e-commerce penetration are shown in the below chart. Despite different starting points for each country before COVID, we estimate that the slope of e-commerce penetration growth now is two to three times steeper than pre-COVID, and that e-commerce penetration will reach high-single-digit percentages in each of Argentina, Brazil, and Mexico by the end of the year. Looked at another way, we believe that e-commerce penetration at the end of 2020 will be at levels that, without COVID, would otherwise only have been reached by 2022 or 2023.

We believe that recently-converted e-commerce customers will stick around at similar rates, and for the same fundamental reasons, as before COVID – more products available at better prices with more convenience is a winning combination. In our view, the pandemic will have compressed the timeline of this conversion by bringing a large new cohort of consumers online so they can learn this for themselves. At the same time, we believe COVID-driven increased spending from existing cohorts will also prove durable as users accelerate their experimentation in purchasing new categories online.

The COVID Impact in Brazil

Rising e-commerce penetration

Brazil is the largest retail and e-commerce market in Latin America and has the highest e-commerce penetration in the region, making it a natural geography to dig into to better understand the impacts from COVID. When offline retail began its dramatic decline, e-commerce growth accelerated from approximately 25% YoY in 1Q20 to more than 90% YoY in 2Q20.3 This resulted in penetration rising dramatically from mid-single-digit percentages pre-COVID to 10% in 2Q20, as shown in the chart below.

While all e-commerce players in Brazil grew as consumers were forced online to shop, the benefits of this shift were not evenly distributed. As noted in our previous post on COVID’s impact on e-commerce in China, we believe three underlying factors are the most important elements of platform performance: first, supply (the availability of goods in a crisis is easier to monitor in a first-party (“1P”) business model than in a third-party (“3P”) model); second, logistics (where again, dependence on third parties introduces uncertainty); and third, demand (which is a function of consumer preference).4

In China, 3P platforms suffered more than 1P given the greater control over operations held by 1P platforms. In Brazil, however, where economic activity was much less constrained during the initial wave of COVID, the effects were more nuanced.

MELI – how the largest e-commerce platform executed

Historically Brazil’s top e-commerce platform, MELI was in a relatively weak position in the months leading into the pandemic. 4Q19 was notable not only for record e-commerce sales in Brazil, but also for marking MELI’s largest loss of holiday-season market share in years.5 This competitive dynamic persisted into the first quarter of 2020 and, compounded with the initial effects of COVID on MELI’s 3P merchants, the company found itself in the relatively unfamiliar position of being the slowest-growing e-commerce player in Brazil at the beginning of the second quarter. Meanwhile, its largest competitor B2W (“BTOW”), whose business is more 1P, performed better and gained market share, and smaller e-commerce players like Magazine Luiza (“MGLU”) and Via Varejo (“VVAR”), whose primary businesses were offline retail, disproportionately benefited as they redirected a large part of their offline demand to their own online channels.

The below chart depicts the evolution of e-commerce market share in Brazil over the past few quarters, as reported in company filings. As evidenced in its year-over-year market share loss, MELI is facing its strongest competitive environment yet.

However, the quarterly data shown above obscures MELI’s remarkable performance during adversity, with our research indicating the company was able to execute a very quick turnaround in performance within the second quarter itself. Below are our estimates of market share trends for MELI at a monthly level, which show MELI recovering its initial market share losses by the end of Q2 and subsequently even exceeding 1Q20 levels.

We believe that MELI was able to quickly adapt in a difficult environment by leveraging the formidable logistics network it had built in recent years and strengthening its nascent 1P sales channel, resulting in sustained, positive consumer experience. We discuss our close research on these elements below.

Looking Closer: Kora Field Research in Action

Since April, our Brazil research team has increased the frequency of our e-commerce tracking in an effort to better follow the near-term impacts of the pandemic, rolling out a bi-weekly consumer survey and enhancing research on logistics. Our research showed that MELI initially performed worse than expected (relative to its market share) in terms of client activity in April, but quickly regained lost share in May and maintained it in June. The below chart, which shows the percentage of users in our consumer surveys who shopped on e-commerce platforms in the past two weeks, highlights both MELI’s recovery and its stability of users, relative to peers.

We believe that MELI was able to retain customers for two reasons: first, supply chains remained largely functional in Brazil, allowing 3P merchants to access and sell inventory; second, MELI rapidly expanded its 1P offering. Our research indicates that MELI’s 1P division grew from ~1,500 listings in mid-March to almost 10,000 in August, covering apparel, FMCG (food, beverage, beauty and cleaning products), appliances, and consumer electronics.

Turning from online to offline metrics, we also relied on our e-commerce delivery tracking to understand how COVID was affecting delivery times in Brazil. Because there was not as extensive a shutdown of business operations in Brazil as in other countries, MELI was able to continue to operate with its managed logistics network, making its third-party-based delivery model more of a benefit than a shortcoming to its COVID-era operations. Our package tracking in São Paulo shows that, during the pandemic, MELI offered the fastest delivery times among major competitors, with the average package arriving 1.6 days after payment, faster than peers by almost a full day.

Looking specifically at FMCG items, which were in high demand as the pandemic rolled through the nation, we see that MELI was not only able to deliver these goods fastest (twice as fast as most competitors), but at competitive rates as well (as measured by shipping cost to customers).

The explanation for MELI’s delivery outperformance lies in its heavy investments in logistics capabilities in recent years. These deliberate efforts allowed the company to transform its delivery experience from one that relied purely on its 3P sellers to one that is more directly managed. This model integrates MELI-operated fulfillment and distribution centers with a flexible network of third-party carriers ranging from large logistics operators to small, crowd-sourced independent couriers. In a normal operating environment, we believe this enhanced logistics network allows MELI to offer service that is just as quick and efficient, if not more so, as that of 1P competitors. And in the COVID environment, we believe that MELI’s logistics infrastructure provides greater flexibility, allowing the company to capitalize on an evolving workforce. From our on-the-ground (though socially-distanced) interviews with delivery carriers during this time, we learned that some freelance workers whose jobs were on pause during the pandemic (e.g., taxi, ridesharing, and school bus drivers) picked up work delivering packages for carrier companies that were part of MELI’s network.

Despite the challenges presented to MELI’s 3P business model by COVID, our research shows that the company was able to deliver a consistently positive e-commerce experience to consumers, one that is reflected in the net promoter score (NPS) numbers reported in our consumer surveys. While most players had NPS impacted in April, we saw MELI recover faster in customer estimation, achieving and sustaining consistent best-in-class scores. Our surveys also show us that Amazon (“AMZN”), currently a small player in Brazil, also reflects consistently high NPS scores, a metric we will continue to follow as the competitive landscape evolves.

E-commerce beyond COVID

The trends we have observed in e-commerce in Latin America and China indicate that while COVID is bringing our e-commerce future into the present, it does not do so uniformly across countries or companies.

It is a reminder that, when looking across markets, mental models that frame the challenges and opportunities faced by businesses in any given industry are a necessary but insufficient starting point – reality is often far more complex than theory can describe. This is the basis of our investment approach at Kora – to develop frameworks for understanding opportunity across regions, but to apply them with a local understanding and research on the ground.

A separate but equally important part of our research approach is to evaluate the quality of management teams over a long time horizon. Our view is that great management teams can be trusted to meet the challenge of uncertain times, as exemplified by MELI’s performance during COVID. Over the years that we have researched and invested in MELI, we have developed a strong relationship with its management team, one that allows us to both trust and track their execution. We continue our work and will hopefully soon be moving beyond the current COVID-impacted period to understand where and to what extent the fundamental changes in consumer and merchant behaviors and platform execution are sustained.

Footnotes

1 Retail sales and growth figures for Brazil and Mexico are tracked through official government indices. Argentina lacks a comprehensive retail index, so we calculated retail sales and growth based on aggregated nominal sales data from supermarkets, malls, and home appliance stores, adjusted for inflation.

2 As measured by active purchasers, orders, and gross merchandise value (GMV) as of 2019.

3 Source: Brazilian Electronic Commerce Chamber and Compre & Confie (MCC-ENET).

4 3P sales platforms aggregate merchants who use the platforms to find customers and deliver their products, but who maintain responsibility for their inventory, whereas 1P sales platforms own the inventory that they sell.

5 MELI typically loses market share to e-commerce competitors during the Q4 holiday season, likely due to the fact that its 1P competitors can mount more aggressive and coordinated discounts and marketing campaigns. In 2019, MELI lost 510 basis points of share between Q3 and Q4, compared to 370bps in 2018 and 200bps in 2017 (Sources: Company Filings, YipitData, Kora Estimates).

Disclosures

The information presented in the above post is provided for informational purposes and is intended to provide an update concerning Kora Management LP (together with its affiliates, “Kora”) and the funds and accounts managed by Kora (collectively, the “Funds”), and does not constitute an offer to sell or the solicitation of an offer to purchase any securities, including those of the Funds. The information presented in the above post is confidential and may not be reproduced in its entirety or in part, or redistributed to any party in any form, without the prior written consent of Kora, and does not constitute legal, tax, investment, or other advice, or a recommendation to purchase or sell any particular security. The information contained in the above post is current only as of the date specified, irrespective of the time of posting or of any investment, and does not purport to present a complete picture of Kora or the Funds. Past performance is not indicative of, and not a guarantee of, future results. Notwithstanding the information presented in the above post, investors should understand that Kora is not limited with respect to the types of investment strategies it may employ or the markets or instruments in which it may invest, subject to the terms set forth in the Funds’ offering and governing documents. The investments discussed in the above post have been included to provide a general market update, and are not intended to be, and should not be construed as, investment advice or a recommendation to purchase or sell any particular security. As of the time of writing of the above post, certain of the Funds held a long position in MercadoLibre (“MELI”). Both before and after the time of writing the above post, without making any public or other disclosure except as may be required by applicable law, such Funds may, at any time, buy and sell securities and instruments of MELI (and other companies mentioned herein) based upon such factors as Kora may, in its discretion, deem relevant. The information included in the above post has been obtained from sources Kora believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. The above post contains certain “forward-looking statements,” all of which are subject to various factors, any or all of which could cause actual results to differ materially from projected results. Nothing contained herein is designed to constitute an offer of new or additional investment advisory services.